|

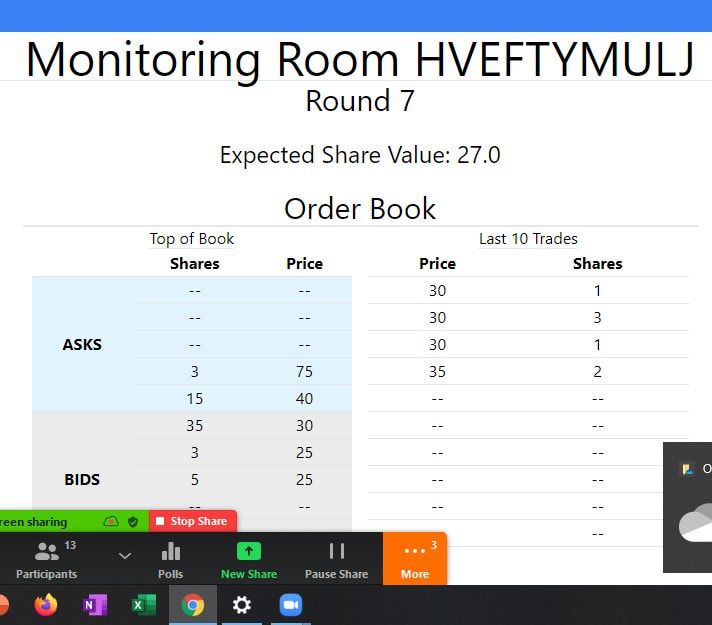

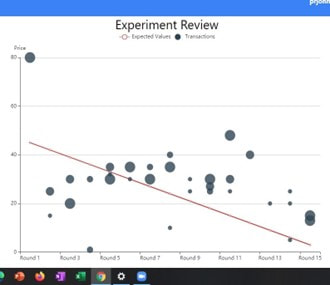

For Instructors: begin here. How to run the Asset Market "Bubble" experiment (Never use the word "bubble" when explaining the experiment: that is for the debrief) In the "more" section shown above there is a link to academic papers and sources related to this experiment. A note on debriefing: at the conclusion of the experiment the instructor sees and projects the experiment review screen (the pattern of trades), while the students see and report the final scores per team. The faculty screen does not show the team scores. There is no upper limit on the number of teams that can compete. Setting Up Kaivik: First Time Instructions The first time an instructor uses Kaivik they will set up a personal free account on the Kaivik server. This allows the creation of financial market experiments by using the Dashboard. The instructor needs to save a login email and password for future reference. If they forget their login information they will lose the history of prior experiments. To get an account go to Kaivik.us On the right side of the screen is the first time user email registration and password setup. After that the instructor can use the same registration and password for all future runs. The email does not have to be the users actual password, it can be any made-up password since it only acts as an identifier for locating past runs. The Dashboard will keep a record for each experiment run listed under a unique ten letter upper case run code, for example "JTBGOHLPDM" Each run of the experiment is linked to a unique “Room” labeled with the ten-letter run code. This allows retrieval of any prior run history provided the instructor keeps a record of prior run codes. When using Kaivik the word “room” actually means a single specific experiment run. Setting Up Kaivik: Setting Up an Experiment Run The order of steps for the instructor: Have students divide into teams with two or more students each, with one student acting as the data entry person on one device per team. The device can be a laptop or a cellphone. There does not need to be an even number of teams. Three or four members per team seems optimal. One team member will be typing buy/sell orders as the team trades. The other team members are strategists, monitoring the game play and telling the typist what to enter. There is no upper limit on number of students on a team. Teams can have different numbers of members. After the instructor has set up teams they explain how teams will be competing in the trading market to make the most money. it is recommended that in the spirit of experimental economics the winning team/s be rewarded with a generous amount of the instructor's cash to encourage competition. Grade points should never be used as an incentive given the element of chance in the experiment. Explaining the rules of the game to students. The instructor warns students not to do anything more until they are explicitly instructed to. The instructor follows these steps:

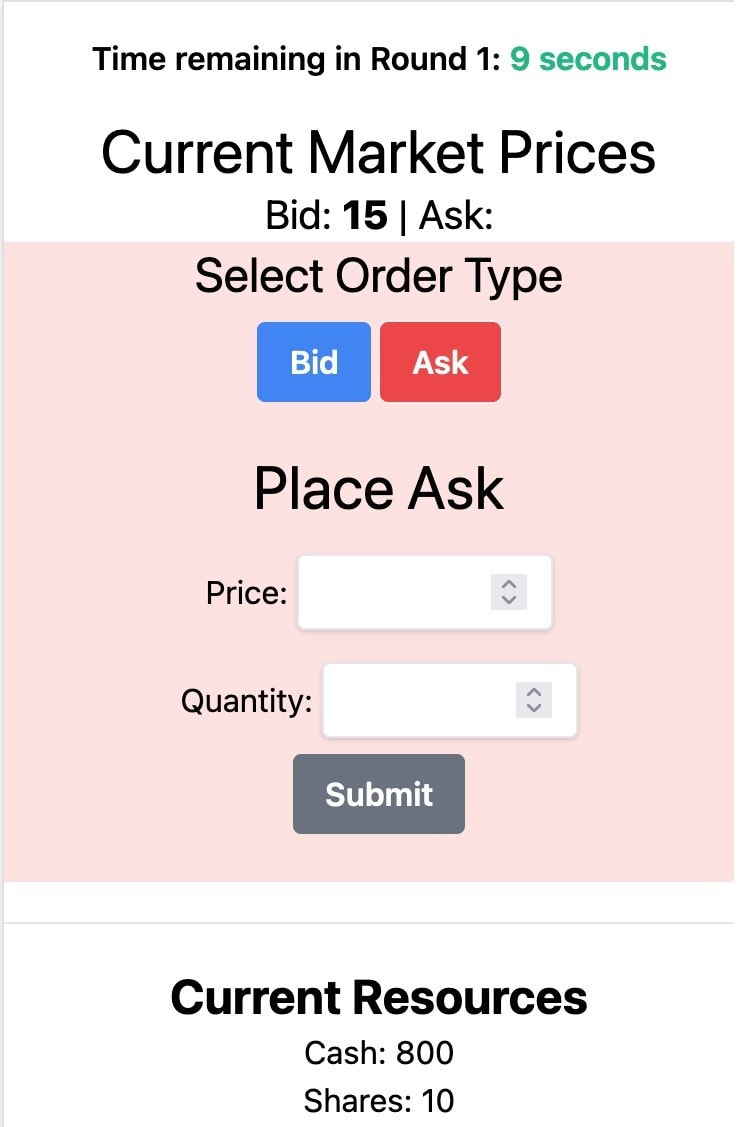

Initial cash endowment per team Initial share endowment per team Probability distribution of share dividends each round.

A sample short script for explaining the experiment

Running Kaivik after the game has been explained and student teams have been set up. The order of steps for running the experiment are:

|